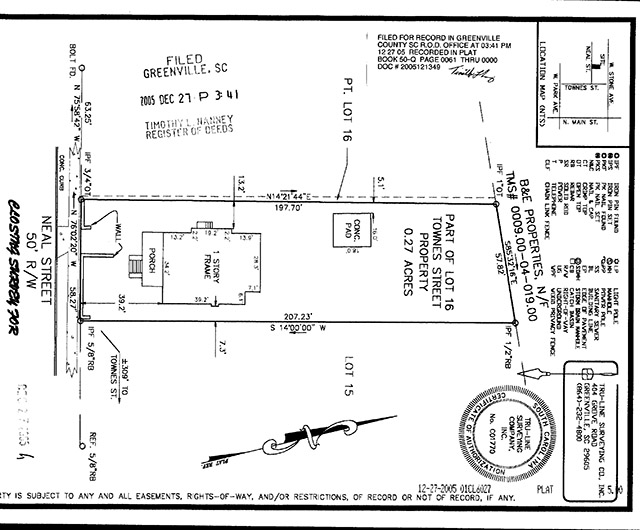

Closing or Mortgage Surveys

Closing & Mortgage Surveys

Usually required by Lender or Title Insurance provider

Mortgage surveys are often required when you purchase a home; it’s a way for your mortgage lender to verify that the property they’re lending you money to purchase, is as described, in legal documents and is suitable as collateral for your mortgage loan.

A mortgage survey is different from a boundary survey and is not used for construction or for boundary determinations. A mortgage survey is usually requested by your mortgage lender or title insurance company and is intended to provide proof that certain improvements are actually located on the property as described in the legal description. These surveys identify the major buildings on your property such as the house, garage, swimming pools, and sheds or other structures, as well as whether your property encroaches on any neighboring properties or easements. Likewise, these surveys determine whether any neighboring properties encroach on your property.

Some properties have zoning restrictions that cover a particular area like a street. Breaking zoning restrictions can make you liable to legal action and penalties from the governing authority. Also, improvements made by the previous owner that are not located on their previous survey may not be covered for the new buyer without a new survey showing the updated improvements to the property.